2024 Tax Updates: What You Need to Know About Tax Brackets, Social Security Benefits, and More

Table of Contents

- Social Security Max 2024 Withholding Paycheck - Annora Rozanne

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 ...

- YOUR Taxes in 2024 - Will YOUR Social Security Be Taxed? - YouTube

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

- Today! Confirmed Adjustments to Social Security and Medicare for 2024 ...

- Maximum Social Security Withholding 2024 - Lynna Rosalia

- HUGE CHANGES! Social Security INCREASE by Double Tax Elimination - SSI ...

- BIGGEST SOCIAL SECURITY INCREASE IN 2024 *Must Watch* - YouTube

- 2024 Social Security & the Massive Changes Coming... SSA, SSDI, SSI ...

- Social Security Tax Maximum 2024 - Cathi Danella

2024 Tax Brackets

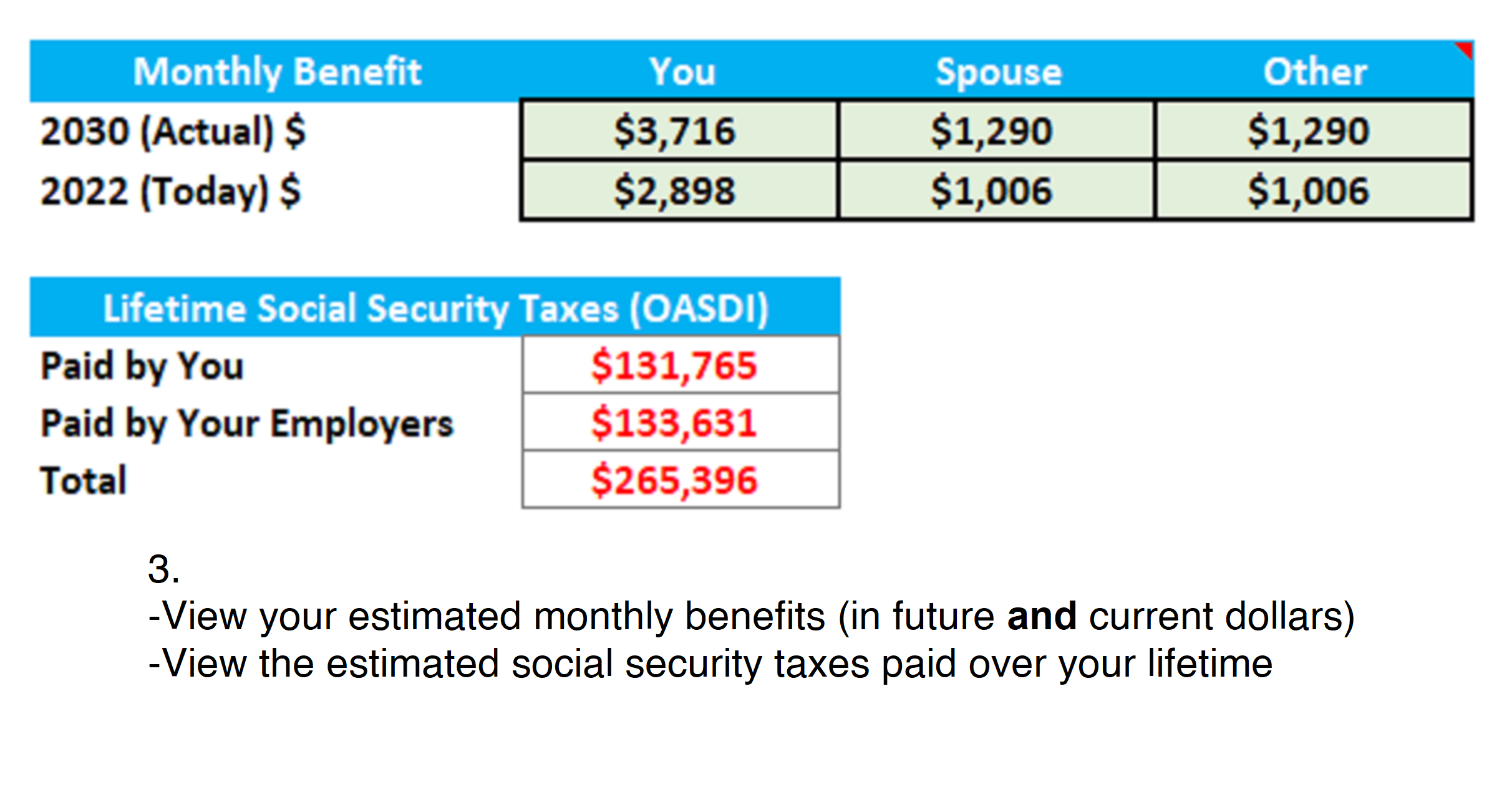

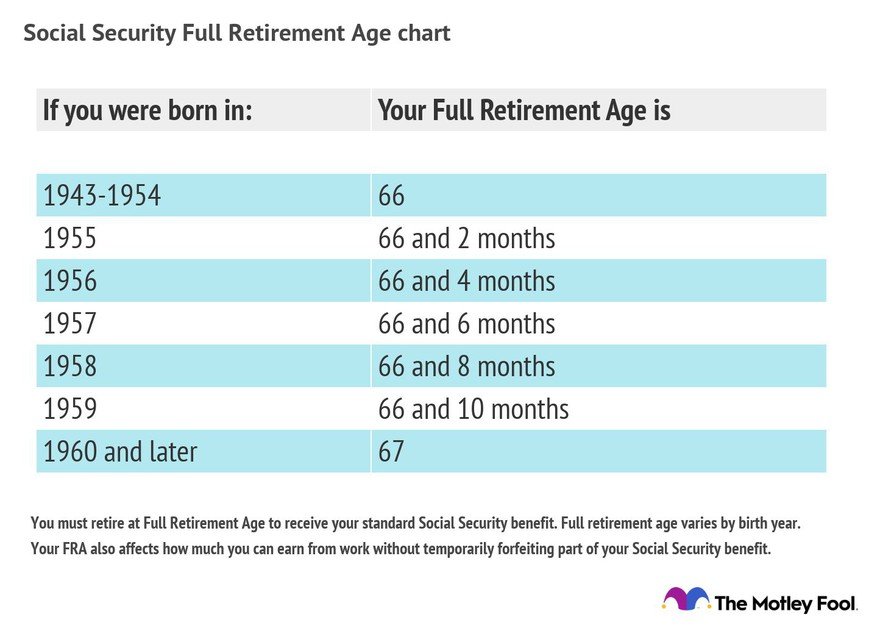

Social Security Benefits Increase

Other Key Updates

In addition to the tax bracket changes and Social Security benefits increase, there are several other key updates to be aware of: Standard Deduction Increase: The standard deduction for 2024 will increase to $13,850 for single filers and $27,700 for joint filers. 401(k) Contribution Limit Increase: The contribution limit for 401(k) plans will increase to $22,500 in 2024, with an additional $7,500 catch-up contribution allowed for those 50 and older. Estate Tax Exemption Increase: The estate tax exemption will increase to $12.92 million in 2024, with a top tax rate of 40%. The 2024 tax updates bring several changes that may impact your finances, from the new tax brackets to the Social Security benefits increase. By staying informed and planning ahead, you can ensure that you're taking advantage of the latest tax savings opportunities and making the most of your hard-earned money. Whether you're a retiree, a small business owner, or an individual taxpayer, it's essential to stay up-to-date on the latest tax updates and changes to make informed decisions about your financial future.For more information on the 2024 tax updates and how they may impact your finances, consult with a tax professional or financial advisor. Stay ahead of the curve and make the most of the new year by staying informed and planning ahead.